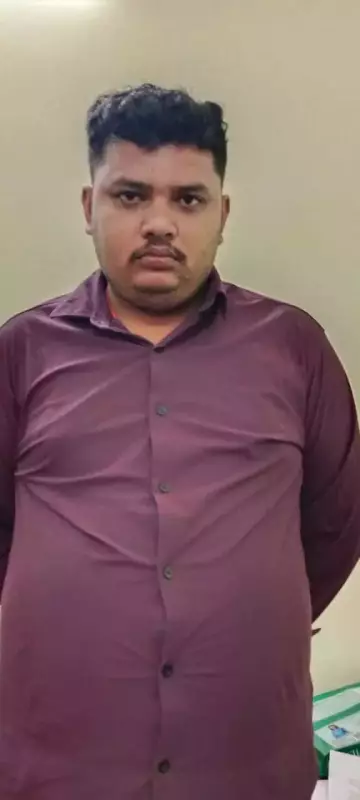

In a significant development that has sent shockwaves through Bhubaneswar's corporate circles, police have apprehended a former employee of a private firm for allegedly orchestrating an elaborate financial fraud amounting to a staggering ₹15 lakh.

The Elaborate Scheme Uncovered

According to investigative sources, the accused individual, who previously held a position of trust within the company, systematically diverted funds through a sophisticated network of forged transactions and manipulated financial records. The fraudulent activities continued over a considerable period before alert company officials noticed discrepancies in their accounts.

How the Fraud Was Executed

The modus operandi involved several calculated steps:

- Creating fake vendor accounts and payment requisitions

- Manipulating transaction records to conceal the illicit transfers

- Exploiting position-based access to financial systems

- Routing funds through multiple accounts to obscure the money trail

Investigation Breakthrough

The Cyber Crime cell of Bhubaneswar Police, acting on a formal complaint from the affected company, launched a comprehensive investigation. "Our technical team followed the digital footprints meticulously," revealed a senior police official involved in the case. "The evidence clearly pointed toward the former employee's involvement in this sophisticated financial deception."

Current Legal Status

The accused has been formally charged under multiple sections of the Indian Penal Code relating to cheating, criminal breach of trust, and forgery. Police authorities have confirmed that further investigation is underway to determine if additional individuals were involved in the elaborate scheme.

This case serves as a stark reminder for corporations to implement robust financial controls and regular audit mechanisms to prevent internal fraud. Business experts emphasize the importance of segregation of financial duties and periodic review of transaction patterns to detect anomalies early.