Rupee to inch up ahead of RBI policy decision

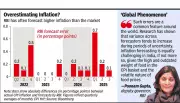

The Indian rupee is set to open firmer on Friday, supported by a recovery from its all-time low. All eyes are now on the RBI's interest rate decision and its stance on the currency. Read for key market indicators and expert analysis.